The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every weekend in your inbox.

Hi there, new and returning readers. This is The Station, a weekly newsletter dedicated to all the ways people and packages move (today and in the future) from Point A to Point B.

There is a lot to get to, so let’s dive right in.

My email inbox is always open. Email me at kirsten.korosec@techcrunch.com to share thoughts, criticisms, offer up opinions or tips. You can also send a direct message to me at Twitter — @kirstenkorosec.

Micromobbin’

Rebecca Bellan is back with some micromobbin’ insights. Let’s dig in and take a look at this roundup of news.

It was a buzzy week for ebikes news, another indication that there is still demand — or at least the perception of demand — for this form of mobility.

Take Gocycle as just one example. The UK-based company released its fourth generation of folding electric bikes, which are claimed to be lighter and more powerful. The new line is made of three models — the G4 ($3,999), G4i ($4,999) and G4i+ ($5,999) — and they all have 20-inch wheels, a sealed chain drive with a 3-speed rear hub transmission, hydraulic disc brakes, a polymer reach shock and a 500-watt front motor. This is all to say, this bike can rip.

Ebike sharing also continues to be a busy market with startups making plans and governments making orders.

Smoove, a French mobility startup. is partnering with Zoov, another mobility startup that focuses on IoT and self-diagnosis features, to try to become leaders in the European e-bike sharing market. Smoove is already well-placed in major cities like Paris, Vancouver, Lima and Moscow, and now will be joining forces with Zoov’s high quality tech and compact docking stations.

China-based EZGO announced an order of e-bikes to the Ukraine worth 1 million RMB, or about $150,000. Ukraine is also purchasing EZGO’s “Dilang” brand of e-modes, as well as some electric tricycles. The company hopes to begin distribution within the next couple of weeks.

Meanwhile, in the land of policy …

A council committee has delayed votes to make changes to e-scooter and e-bike sharing schemes in Denver.

The deal they’re working out involves allowing the two micromobility companies to get free access to operating on the city’s streets. Usually, these companies would pay the city for the right to operate, but if the Denver City Council approves their licenses, Lyft and Lime will just be making profits. The upside is that it (hopefully) gets more people out of cars and into more sustainable modes of transport. This deal also doesn’t require Denverites to contribute to funding, unlike the deal Denver had with B-cycle, the city’s original bike share nonprofit.

— Rebecca Bellan

Deal of the week

Lilium became the latest electric vertical take-off and landing aircraft startup to seek capital by going public via a reverse merger with a “blank check” company. In this deal, Lilium announced a merger with special purpose acquisition company Qell Acquisition Corp, in a deal valuing the combined business at $3.3 billion.

(Side note: Qell Acquisition Corp. is a SPAC led by Barry Engle, a former president of General Motors North America.) Once the merger is complete, Lilium will trade on the Nasdaq exchange under the ticker symbol LILM.

The German-based startup designs and builds eVTOLs and has aspirations to launch commercial air taxi operations in 2024. Lilium plans to launch an air taxi network in Florida with up to 14 vertiport development sites, which the company says will be built and operated by its infrastructure partners.

Other deals that got my attention …

Chargerhelp!, an on-demand EV charger repair startup, has raised $2.75 million from investors Trucks VC, Kapor Capital, JFF, Energy Impact Partners and The Fund. This round values the startup, which was founded in January 2020, at $11 million post-money. The startup is interesting to me because as far as my research has shown there isn’t a lot of competition; and there should be. They also have a progressive (dare I suggest sustainable approach) to hiring.

Glovo, a startup out of Spain with 10 million users that delivers restaurant takeout, groceries and other items in partnership with brick-and-mortar businesses, raised $528 million in a Series F round. The round is significant not just because of its size, but because of its proximity to Deliveroo’s raising more than $2 billion ahead of its debut on the London Stock Exchange this week.

To offset the thin (or even negative) margins that are typically associated with a lot of delivery startups, Glovo aims to become the market leader in the 20 markets in Europe where it is live today, in part by expanding its “q-commerce” service — the delivery of items to urban consumers in 30 minutes or less, TechCrunch’s Ingrid Lunden reported. It will be using the money to double down on that strategy, including hiring up to 200 more engineers to work in its headquarters in Barcelona, as well as hubs in Madrid and Warsaw, Poland to build out the technology to underpin it.

LGN, a UK-based startup focused on edge AI, raised $2 million in a round that included investors Trucks VC, Luminous Ventures, and Jaguar Land Rover.

The company, which was founded in 2018 by former Apple and BMW executive Daniel Warner, Oxbridge research fellow Dr Luke Robinson and Professor Vladimir Čeperić of MIT and the University of Zagreb, plans to use the funds to develop its product and hire more employees. Specifically, the company said it is working on low-latency inference technology that can process optical data on-chip orders faster than current technology allows, VentureBeat reported.

Wavesense, the Massachusetts-based startup that makes ground-penetrating radar (GPR) technology for self-driving cars, raised $15 million in a round led by Rhapsody Venture Partners and Impossible Ventures.

Takeaways from Biden’s plans

What will it take to get Americans to choose an electric vehicle for their next car and to get American supply chains up to the task of manufacturing them in-house? According to President Joe Biden’s ambitious infrastructure plan unveiled Wednesday, the answer is $174 billion.

The funds are just one part of the $2 trillion plan, which seeks to overhaul the lifelines that keep the country running, such as our transportation networks, electric grid and even broadband. In some ways, the plan is bipartisan genius: it combines Democrats’ concern over climate change with Republicans’ concern over Chinese dominance in manufacturing, and appeals to both parties in its promise to revitalize domestic jobs. But the plan still needs approval from Congress before it can move forward.

To spur Americans to buy electric, Biden has taken a two-pronged approach: make them cheaper (through tax credits and rebates) and make EV chargers more readily available (by building a staggeringly large network of 500,000 chargers by 2030). His administration hasn’t released details on the size of the incentives, so it’s unclear whether they will be larger than the $7,500 tax credit already available for EVs. It’s also unclear whether Tesla and GM will qualify, as the current credit isn’t available for manufacturers that have already sold more than 200,000 EVs.

For now, Biden’s administration is withholding a lot of details — how will his plan help automakers “spur domestic supply chains from raw materials to parts” and “retool factories to compete globally”? — so we’ll keep an eye out for these details in the future.

— Aria Alamalhodaei

Argo AI plots its fundraising course

I dared to take some time off, which is all well and good until news breaks in the world of autonomous vehicles. A report from The Information said that Argo AI CEO and co-founder Bryan Salesky told employees in an all-hands meeting that the autonomous vehicle startup was planning for a public listing later this year.

I connected with some sources – vacation be damned — and have more context to share with you. Salesky did indeed mention the prospect of an IPO during the company’s regular weekly all-hands meeting. There is a bit more to the story though. The comments were made as the CEO discussed upcoming important milestones in 2021 that will lead to an IPO or a significant raise of some kind. The upshot: apparently all fundraising options are on the table, including a merger with a special acquisition company or SPAC.

Argo, as one source told me, is intent on scaling. Raising capital is a key part of that plan. The company also plans to expand testing beyond the six cities it currently is in — including into Europe. (Remember, Volkswagen is a backer and a customer. )

All of that takes money. Argo has raised $2 billion to date. That’s no small sum and yet far below the war chests of Cruise and Waymo.

The fundraising effort has not started in earnest. There is no roadshow, according to folks familiar. The broad plan is to secure investors, which could turn into the PIPE (private investment in public equity) for a SPAC or a “fairly substantial private round,” according to one insider.

Waymo’s changing of the guard

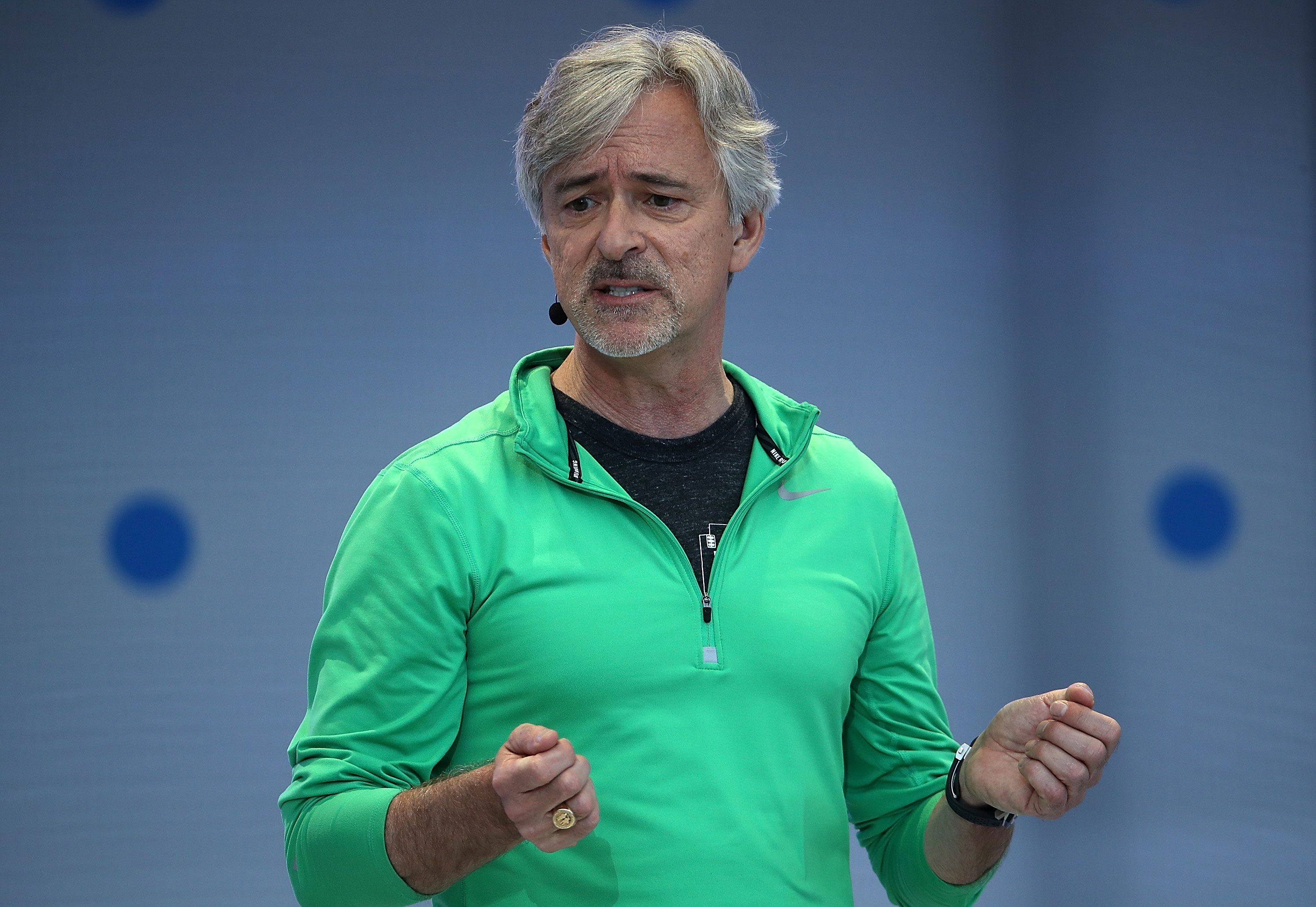

Waymo CEO John Krafcik announced on Friday that he is stepping down from the leadership position he held for five years. The CEO position will now be held by two people: Tekedra Mawakana, who was COO and Dmitri Dolgov, who was part of the original Google self-driving project and was most recently CTO.

The idea is that the co-CEOs will take their respective expertise — business and engineering — and combine them to help Waymo scale up commercially. Co-CEO models are risky, so it will be interesting to see if the pair can work together, and importantly, get their employees to buy into the idea. Dolgov and Mawakana apparently brought the co-CEO idea to the board, one source told me. (Remember Waymo is an Alphabet company, and so its leaders ultimately answer to their parent.)

In a post on LinkedIn, Krafcik described his time at the company and hinted at a few of his plans, which for now seems to be focused on settling in Austin, Texas and regrouping with family and friends. He’s also now listed as an advisor to Waymo, a contractual position that doesn’t have a specific end date.

As you might suspect, I received lots of texts and email messages from sources within the industry wanting to weigh in or provide inside information (or speculate) why Krafcik left.

Here’s what I can tell you. Krafcik could be a polarizing figure within Waymo, particularly in the early days of his employment when it was still a “project” and had not yet become an independent company under Alphabet. That transition led to the departure of some of the Google self-driving project’s key engineers and leaders, including Chris Urmson, Bryan Salesky and Dave Ferguson, who went on to found AV startups Aurora, Argo AI and Nuro.

Krafcik’s tenure was also marked by extreme growth — in terms of number of employees — as well as an aggressive push to lock up OEM and supplier partners, the launch of a ride-hailing service in the suburbs of Phoenix, expanded testing and its first external investment round of $2.25 billion. That round was extended by another $750 million, bringing the total size of the financing to $3 billion.

Dolgov and Mawakana have some decisions to make on how they want to proceed and where to place their bets. My educated forecast? Waymo Via, the company’s autonomous delivery unit, will become a bigger priority along with a more visible push into complex urban environments like San Francisco.

Notable reads and other tidbits

Here are a few other items worth mentioning.

It’s electric

Amazon Web Services is expanding its offerings and anticipating the inevitable spike in EVs by partnering with Swiss automation company ABB. The two are working on a single-view electric fleet management platform that can work with any charging infrastructure or EV.

“Not only do fleet managers have to contend with the speed of development in charging technology, but they also need real-time vehicle and charging status information, access to charging infrastructures and information for hands-on maintenance,” Frank Muehlon, president of ABB’s e-mobility division, told TechCrunch. “This new real-time EV fleet management solution will set new standards in the world of electric mobility for global fleet operators and help them realize improved operations.”

Autonomous vehicles

Cartken, the robotics startup founded by ex-Google employees, has partnered with REEF Technology to bring self-driving delivery robots to the streets of downtown Miami. REEF, a startup that operates parking lots and tech-focused neighborhood hubs, to develop and deploy the robots. They are now delivering dinner orders from REEF’s network of delivery-only kitchens to people located within a 3/4-mile radius of its delivery hubs.’

Geodis, the global logistics company, has tapped startup Phantom Auto to help it deploy forklifts that can be controlled remotely by human operators located hundreds, and even thousands, of miles away. The aim is to use the technology to reduce operator fatigue — and the injuries that can occur as a result — as well as reduce the number of people physically inside warehouses, according to the Geodis.

Motional, which is partnering with Lyft for ride-hailing services, revealed this week that it would be integrating its tech with the Hyundai IONIQ5. Customers in certain markets will be able to book this vehicle starting in 2023.

Optimus Ride, an autonomous electric mobility company, announced a partnership with sports car manufacturer Polaris to commercialize a new breed of Polaris GEM low-speed vehicles. The vehicles will serve as microtransit for certain academic or corporate campuses, mixed-use developments and other geofenced, localized environments. Side note: 2023 seems to be a big year for upcoming electric, autonomous vehicles.

Delivery

Zipline, the drone delivery service startup, announced a partnership with Toyota Tsusho

Corporation that will focus on bringing medical and pharmaceutical supplies to healthcare facilities in Japan. Toyota Tsusho is already an investor in Zipline and so this is a deepening of that relationship.

The partnership also marks Zipline’s entrance into Japan. The company already delivers medical supplies in Ghana and Rwanda, and also operates in the United States.