Your privacy is at risk. Wake up and learn how governments are increasing monitoring of your every moves.

Norway, Sweden, and Israel partner to test CBDCs

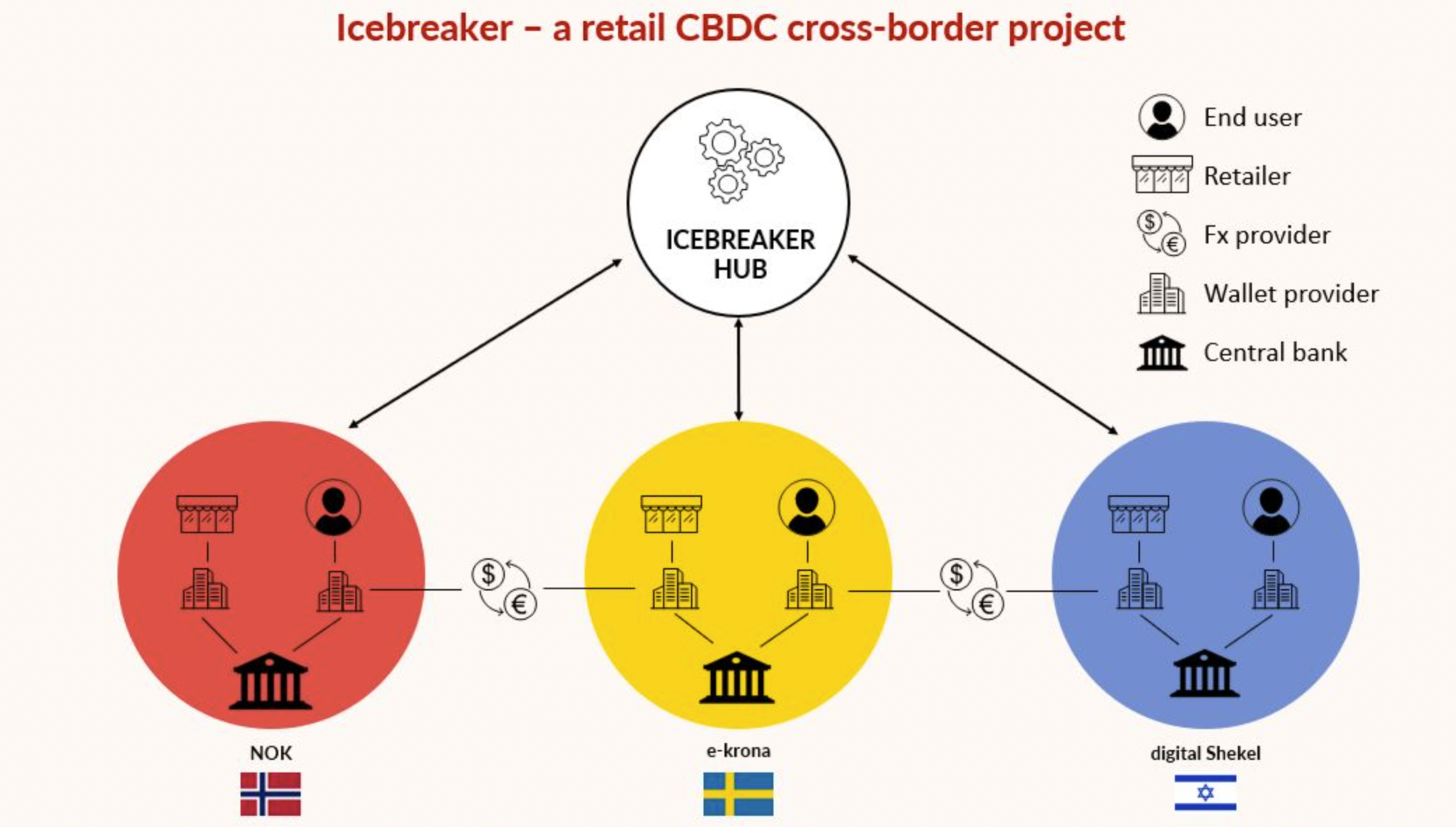

The central banks of Israel, Norway, and Sweden, as well as the Bank of International Settlements (BIS), have teamed on a project, called Project Icebreaker, to test the feasibility of central bank digital currencies (CBDCs) for cross-border payments.

Project Icebreaker’s purpose is to enable fast cross-border payments using CBDCs at a significantly lower cost compared to existing systems.

Related: Central Bank Digital Currencies make authoritarianism, censorship, and surveillance easy

The project will create a hub where the participating banks can test key functions and feasibility of their proof-of-concept CBDCs.

Sweden’s central bank, Sveriges Riksbank, is considering issuing a CBDC they have named e-krona.

“Sveriges Riksbank is collaborating in this experiment as part of the e-krona project,” said Mithra Sundberg, head of the e-krona division of Sveriges Riksbank.

“By interlinking our current e-krona platform, developed in a test environment, with the other countries we gain valuable lessons regarding cross-border payments using a CBDC. We also gain better understanding of important design and policy choices needed to secure cross-border functionalities if we decide to issue an e-krona.”

Israel also hopes that Project Icebreaker will help with the development of a digital shekel.

“The results of the project will be very important in guiding our future work on the digital shekel,” said Bank of Israel deputy governor Andrew Abir.

“Efficient and accessible cross-border payments are of extreme importance for a small and open economy like Israel and this was identified as one of the main motivations for a potential issuance of a digital shekel.”

A report on Project Icebreaker is expected in the first quarter of 2023.

The post Norway, Sweden, and Israel partner to test CBDCs appeared first on Reclaim The Net.

See more –> Source